CORE PRODUCT

RaccoonPay: A Hotel Payment Processing Guide

February 1, 2024 Nicky. M

Home > Guest Experience, Hotel Website, Hotels, Technology > RaccoonPay: A Hotel Payment Processing Guide

Share this post

Hotels and other accommodation businesses deal with payments every day. But, unlike most businesses, hotels face unique challenges when it comes to getting paid. For example, they accept payments through third-party sources like Online Travel Agencies (OTAs). They also deal with things like deposits and special guest preferences like online check-ins, and the nature of their business makes them more prone to chargebacks.

That’s a lot, right? And we haven’t even covered half of it.

In this blog, we delve into the power of seamless hotel payment processing and why getting your hotel payment strategy right from the start isn’t just good for revenues but is the key to transforming your guests’ experience and ensuring smooth operations for your business.

Let’s unlock a world where payments elevate your hospitality game!

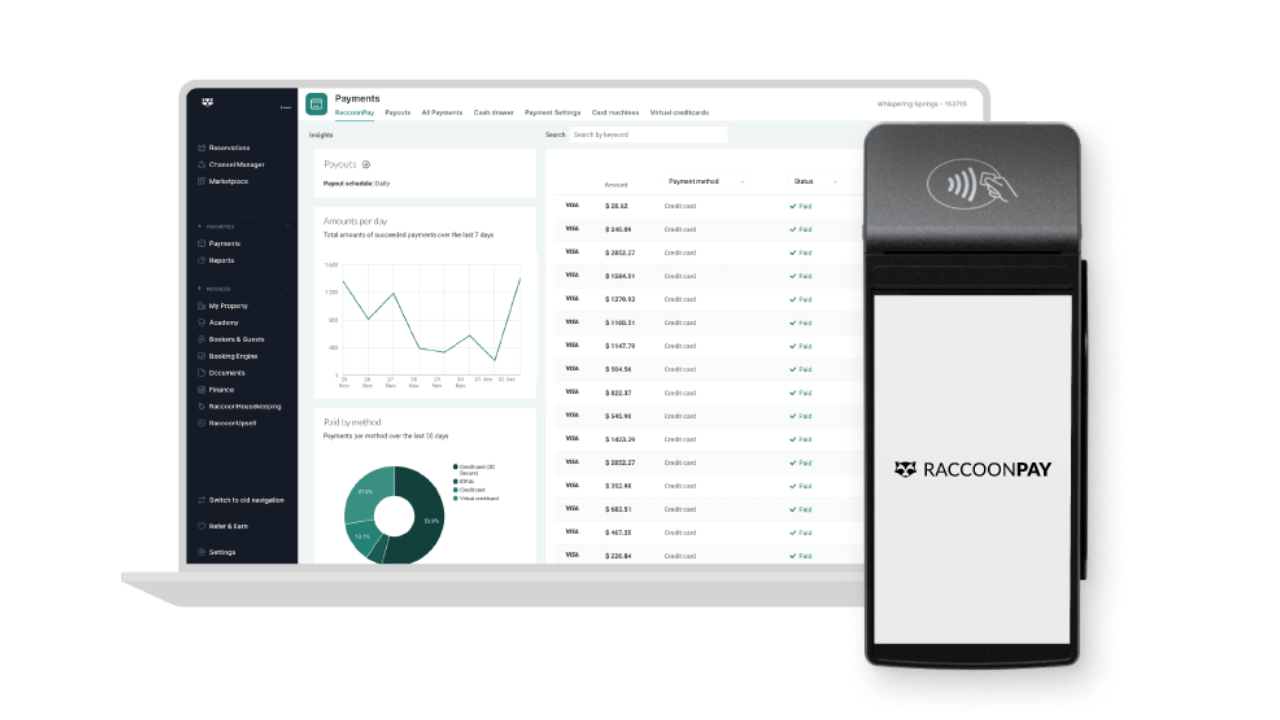

What is RaccoonPay?

RaccoonPay is our fully integrated hotel payment processing system, serving as the backbone for facilitating payments for our esteemed clients across the EU and the US. This sophisticated system is fully integrated with RoomRaccoon’s hotel management platform and is specifically designed to empower hoteliers by streamlining the unique payment processes across their operations and guest touchpoints.

Whether VCC payments, online payment requests, or direct booking engine transactions, RaccoonPay ensures a hassle-free and reliable payment experience for hoteliers and guests.

RaccoonPay offers many advantages, such as secure 3D payments, modern payment methods, and flexible fees, all while adhering to PCI compliance standards. The user-friendly interface makes it easy to manage payments. Try RaccoonPay today and take advantage of a 30-day free trial.

What Are the Main Payment Methods for Hotels?

Are you curious about the most popular payment methods preferred by guests in the accommodation industry? Well, let’s dive in!

- Debit and credit cards

- Cash

- Mobile wallet

- Virtual payment

- Point-of-sale

Debit and credit cards

There are three main types of payment transactions: card-present (CP), card-not-present (CNP), and contactless payments.

CP Transactions

When a guest is physically present at the hotel and uses their credit card to make a payment by inserting or swiping. The guest may also be required to enter their PIN to complete the transaction.

CNP Transactions

Where guests are not present physically at the hotel. These include online payments and MOTO (mail order/telephone order) payments. MOTO transactions are those where the guest provides card details, which are entered manually by the hotel staff or using stored information.

Contactless Payments

The guest can pay without interacting with the payment terminal. They simply need to hold their card or mobile wallet-equipped smartphone over the card terminal, and the terminal will securely read and transfer the encrypted information.

RaccoonPay processes all forms of hotel payment transactions, including:

- Card present (CP) transactions: RaccoonPay’s integrated card machine allows guests to make in-person payments with their credit or debit cards.

- Card not present (CNP) transactions: RaccoonPay’s credit card authorization and tokenization service allows guests to make secure payments online.

- Contactless payments: RaccoonPay supports contactless payments through secure online payments and mobile wallets.

Cash is no longer king

Apart from the fact that cash payments offer no guarantee to hotels, nowadays, fewer travelers carry cash as the world is shifting towards digital payments. Some hotels have even made the decision to go completely cashless. However, to accommodate guests who still prefer cash payments, RoomRaccoon offers a cash drawer, allowing hotels to track the transactions within the system.

What is a mobile wallet or e-wallet?

It’s becoming more common to pay with your phone these days. A mobile or digital wallet is an app that stores your payment information on your phone. Some examples of mobile wallets are Apple Pay, Google Pay, and Samsung Pay. Guests can make contactless payments by holding their phone over the payment terminal.

The RaccoonPay Card Machine accepts both Apple Pay and Samsung Pay mobile wallet payments, enabling hotel guests to simply scan their phone and go.

What is a virtual credit card?

A virtual credit card (VCC) is a temporary credit card number issued by a bank, allowing people and businesses to make online payments without revealing actual card details. OTAs like Booking.com and Expedia often use VCCs to send payments to hotels. VCCs are issued for a specific transaction for a specific amount and have an activation date attached. The downside is that VCCs require manual charging by hotels, and if forgotten, access to the funds will be lost.

RaccoonPay’s VCC dashboard allows for streamlined importing and auto-charging of virtual credit cards from a host of OTAs.

What is the difference between Point of Sale and Point of Interaction?

A point-of-sale system, commonly known as POS, is a designated spot where payment transactions are carried out by using devices such as barcode scanners or cash registers. In contrast, a point of interaction (POI) is a payment device that enables communication between the cardholder’s card and the device using a magnetic stripe, chip, or mobile app.

What Are the Main Hotel Payment Processing Fees?

Online payments are taking over because they’re easier, quicker, and safer than handling cash. But hey, convenience doesn’t come free. Payment services involve complex processes between multiple players, each of whom charges a processing fee for their services.

There are 3 main types of credit card processing fees:

- The interchange rate is a fee imposed by your guest’s issuing bank for each credit card transaction. This fee is conveyed to your payment processor, who then charges you, the merchant, based on a calculation that includes a percentage of the sale and fixed fees. The amount is non-negotiable, representing a cost associated with accepting credit card payments. In essence, you pay the price for the convenience and security of processing credit card transactions in your business.

- An assessment fee is a payment that credit card networks charge for services related to network operations. These services include ensuring PCI compliance, among others. The fees are passed on from the credit card networks to you, the merchant, and are calculated based on several factors. These fees contribute to the framework that allows your business to securely accept credit card payments.

- Payment processor and gateway fees refer to service providers’ costs for processing electronic payments. These fees include monthly and per-transaction fees, and providers may also charge additional fees for setup, terminal rentals, and processing chargebacks. While some flat fees may be negotiable, monthly and per-transaction charges are usually fixed. These fees reflect the expenses related to using the infrastructure and services provided by payment processing entities.

How RaccoonPay keeps hotel transaction fees flexible

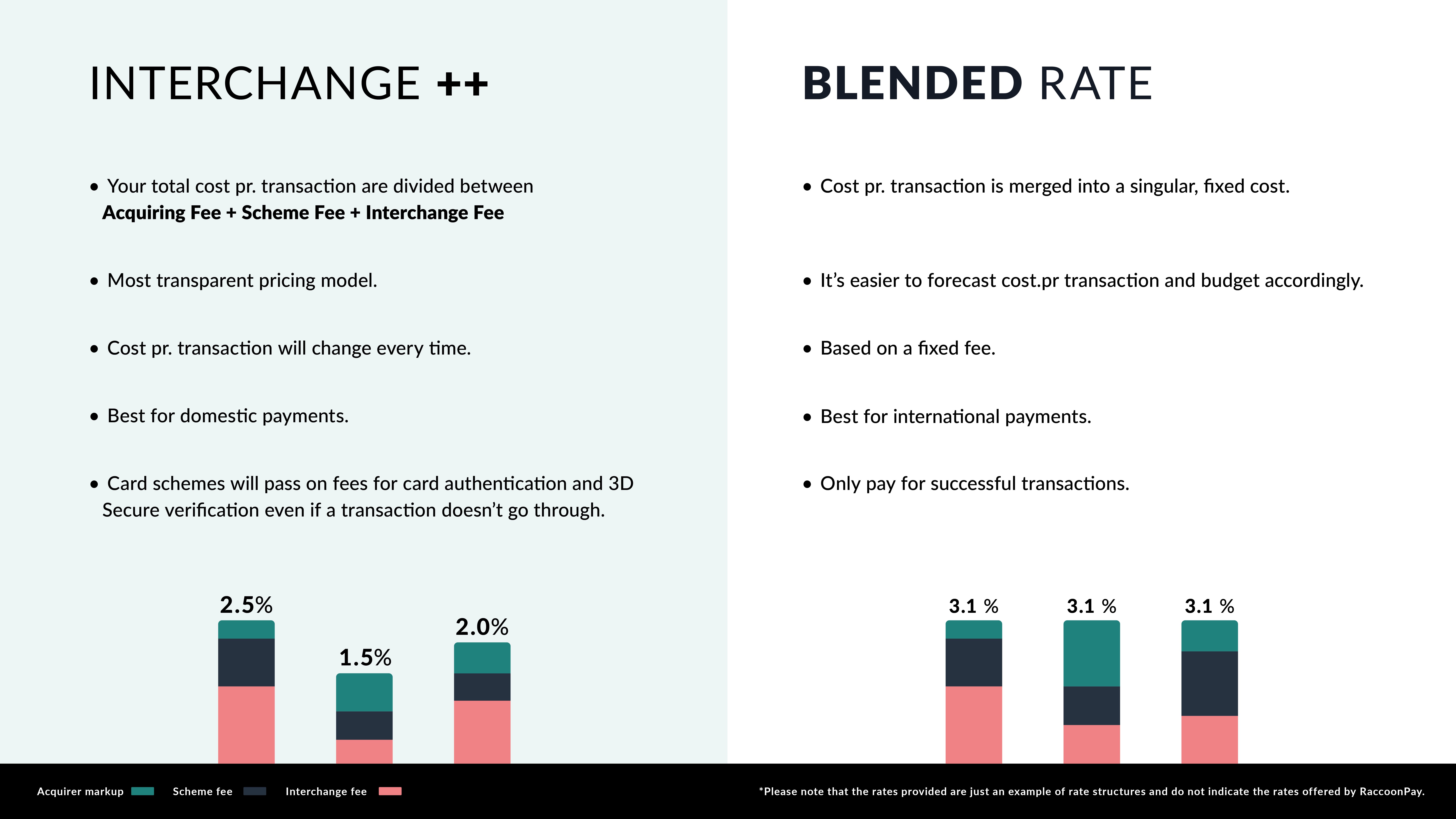

Blended VS Interchange Plus Plus

RaccoonPay provides two payment pricing models, Blended Rates and Interchange Plus Plus, which are widely used in the industry. The main difference between the two is the level of transparency in the billing process.

Each model has its own unique benefits, which we will delve into below:

Interchange ++

The Interchange Plus Plus pricing model offers transparency by separating the card processing charge into three distinct fees. This enables hotels to clearly understand the charges they are incurring:

- Interchange fee: During card transactions, the cardholder’s bank charges the acquirer or the merchant bank for processing the payment.

- Card scheme fee: Card schemes (Visa or Mastercard) charge the merchant bank a fee for the use of their systems and networks.

- Processing fee: The processing fee is the cost that the payment service provider charges to the business for using their services.

Blended Pricing

The blended pricing model includes the three types of fees we’ve discussed above, seamlessly merging them into a singular cost. This means that a hotel won’t be able to tell exactly how much they’re paying for the individual interchange, card scheme, and processing fees.

However, it makes it easier for the hotel to predict their expenses for a specific type of transaction and plan their monthly budget. The pricing model can either charge a fixed fee per transaction or give different rates depending on the type of payment card being used or the number of transactions processed. Blended rates are also more cost-effective for hotels processing many international payments.

Worried About Fraud? Here’s How to Secure Your Hotel Payments

The hotel industry operates in a high-value transactions sector. This puts hotels directly on the radar of fraudsters and cyber attackers skilled in getting past basic online defenses.

Hotel payment processing systems must adhere to industry security standards and include the most up-to-date fraud protection tools:

- PCI-compliance

- Payment tokenization

- Chargeback support

- Payment Authorization

- Prepayments

- 3D Secure hotel payment processing

Learn more about hotel payment security with RaccoonPay.

The Benefits of an Integrated Hotel Payment Solution

Hotels are still struggling with too many systems, meaning they have to spend ages reconciling payments and have no way of providing a connected guest experience with payments seamlessly woven into the guest journey.

1. Delight your guests

According to a study by Amadeus, hotel payments are a significant factor in guest satisfaction. The most highly-rated hotels cater to guests’ preferred payment methods and offer them more ways to pay. With integrated payments, you can seamlessly weave payments into the guest journey. Are you sending online check-out instructions? Why not include a secure payment link for both your and the guest’s convenience?

2. Speed up payments

When your payment processing system isn’t connected to your PMS, guests are taken to third-party websites or apps for online transactions, which causes friction and delays. Meanwhile, with an integrated solution, payments are automated, ensuring swift capture of payment details with a simple card tap, storing the information in the guest profile for future stays.

3. Avoid data entry errors

Opting for manual card details entry increases the chances of making mistakes and results in higher fees and chargebacks. On the other hand, an integrated payment processing system minimizes errors in data entry and calculations, freeing up staff from the burden of rectifying issues. As a result, reports generated by the system can be relied upon for their accuracy.

Learn more about RoomRaccoon’s hotel performance reports.

4. Make reconciliation a natural part of your operations

When you centralize your payments, you can benefit from automatic payment reconciliation. With a single guest profile for all transactions and one contact point for resolving issues, everything is synchronized within your PMS. You don’t need to spend time transferring data anymore. Say goodbye to manual work and enjoy the convenience of having all your payment information in one place.

5. Save time and costs

Many hotel owners shy away from taking credit card payments because they think it’s pricier than dealing with cash. But it’s crucial to consider the downsides of avoiding credit cards, like losing bookings, spending more on manual labor, dealing with cash shortages, and the risk of theft. If you team up with an integrated payment processing system that handles everything, you can skip the middlemen, get your money’s worth, and save time and costs on training your staff to handle different systems.

Diversify & Delight: Hotel Payment Channels With RaccoonPay

From self-check-ins to local payment preferences, the expectations of today’s guests are high. And not all accommodation businesses do things the same way… and that’s okay! For instance, serviced apartments and vacation rentals mostly take digital payments. This is most likely because they don’t have traditional front desks. On the other hand, bed and breakfasts still accept in-person payments to provide a more intimate and homey experience.

What’s important is to have the flexibility of choosing payment channels that seamlessly integrate into your guest journey. Relying solely on one payment channel can make your business vulnerable to disruptions.

RaccoonPay offers a range of payment channels to collect payments at every stage of the guest journey. Take a look at our options.

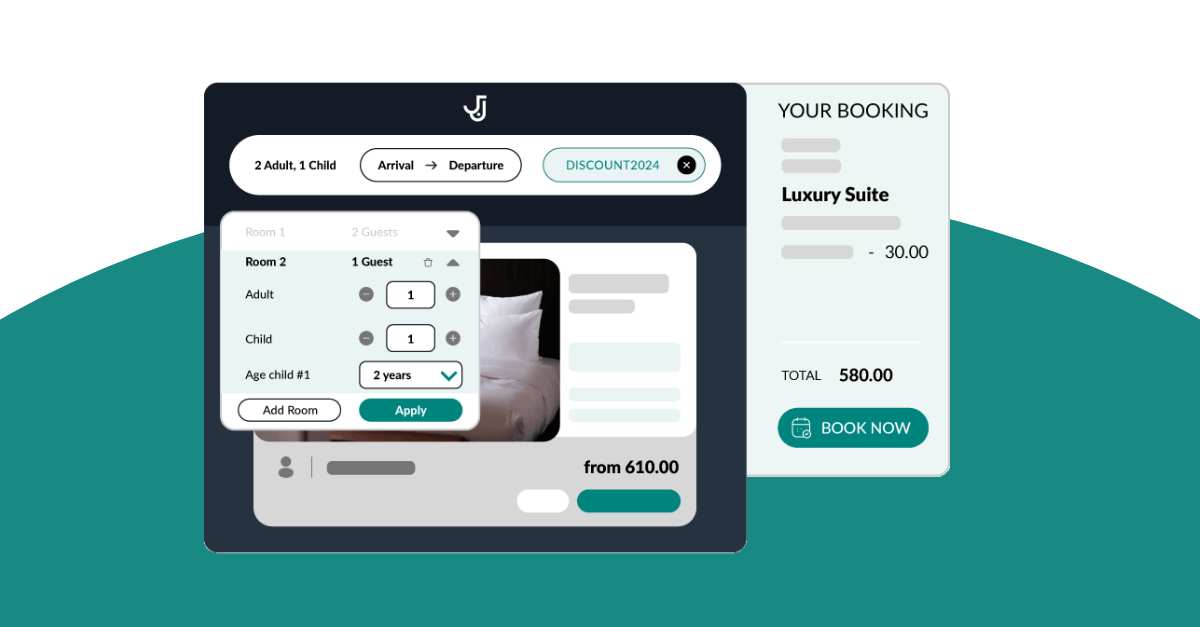

1. Hotel Website

Guests can easily book directly through your hotel’s official website using the RoomRaccoon hotel booking engine, which is equipped with RaccoonPay for online payments. Guests can pay using their credit cards or other online payment methods.

You have the flexibility to set conditions, such as collecting the partial booking amount or the full amount to secure bookings. Guests can also enhance their stay by booking additional services such as spa treatments or food baskets, increasing the overall TrevPAR.

2. Online Check-in and Self-Check-out

If you don’t wish to charge your guests at the time of booking, you can ask for payment during online check-in using a secure payment link. Similarly, you can set up an automated check-out process that sends a check-out request with a secure payment link, allowing guests to pay any remaining balance before they depart.

According to a 2021 Skift report, 54% of travelers said that they’d most like to use online check-in and checkout services at hotels. Why not combine this important guest touchpoint with an easy way to pay and enhance the overall experience for guests?

3. In Person

During their stay, guests pay using various payment options such as credit cards, debit cards, mobile wallets, or cash. They can easily settle their accounts through a payment terminal located at the front desk or a point-of-sale (POS) system available throughout the property, be it during check-in, check-out, at the spa, restaurant, or any other time of their stay.

While older generations tend to use cash or credit cards, younger generations are opting for mobile wallets as their preferred payment method. The RaccoonPay Card Machine accepts both Apple Pay and Samsung Pay mobile wallet payments, enabling hotel guests to simply scan their phone and go.

4. Digital Payment Requests

Are you tired of chasing after payments from your guests? Well, payment reminders might just be the perfect solution for you! Not only do they help prompt payment at any time, but they also give you the flexibility you need in the payment process.

By sending a payment request via email, guests can conveniently and securely pay via a provided link. This helps to streamline the payment process, making it faster and more convenient for both the hotel and the guests.

5. Booking Proposals

RoomRaccoon has developed a process that converts provisional bookings into confirmed bookings. Rather than engaging in lengthy email exchanges, hoteliers can send a booking proposal document, including stay details and pricing, to the enquirer.

The proposal includes expiration dates to create a sense of urgency. Once a guest confirms and pays, the reservation status changes from “Provisional” to “Confirmed,” streamlining the booking and payment process.

Learn more about how to turn inquiries into direct bookings with RoomRaccoon.

6. Virtual Credit Card

RaccoonPay’s VCC dashboard simplifies payment management by eliminating the need to access OTA extranets. The information is easily imported into RoomRaccoon via our channel manager.

With this dashboard, hotels can view the reservation, expiration date, associated booking channel, and the amount. Additionally, the dashboard allows hotels to automate the charging of VCCs on the activation date, eliminating any concerns about forgetting to charge the VCC.

Checking Out

Payments are pivotal in hotel operations, serving as the lifeblood that keeps everything running smoothly. Any disruptions in this process can result in time delays, increased costs, and dissatisfied guests.

This highlights the significance of a seamless hotel payment processing system, such as RaccoonPay, which is integrated into our hotel management platform, simplifying the daily lives of hoteliers and ensuring reliable reporting. Start your 30-day free trial today. No payment details are required.

Follow us

Nicky. M

Nicky is RoomRaccoon's Senior Content Manager, combining a love for travel with a practical approach to improving hotel performance through tech and insightful tips. Join her journey where travel, hospitality, and technology meet.

Related Posts

Subscribe to our newsletter for more on the latest hospitality & RoomRaccoon updates delivered straight to your inbox!