CORE PRODUCT

Navigating Secure Online Payment Processing: Strategies for Hoteliers

March 6, 2023 Nicky. M

Home > Guest Experience, Technology > Navigating Secure Online Payment Processing: Strategies for Hoteliers

Share this post

Over the years, hotels have increasingly shifted their operations into the digital space. This has resulted in significant changes in the way guests book their stay, access services, and make payments. However, with the rise of online transactions, secure payment options have become a major priority for hotels.

Hotels are taking measures to ensure the security of payment processes, especially as they rely more and more on online channels. In this era of digital innovation and heightened security concerns, hotels must adopt robust measures to protect sensitive financial information and maintain the trust of their guests.

Are you a hotel owner or manager? Check out our blog for tips on how to secure your payments.

How to Secure Hotel Payments

The biggest risk facing hotels is growing credit card fraud, which has doubled over the past seven years. Online fraud and data breaches cause damage to the hotel’s reputation, loss of their most loyal customers, and a drop in their bottom-line profits.

How do you know if your hotel payments are truly secure?

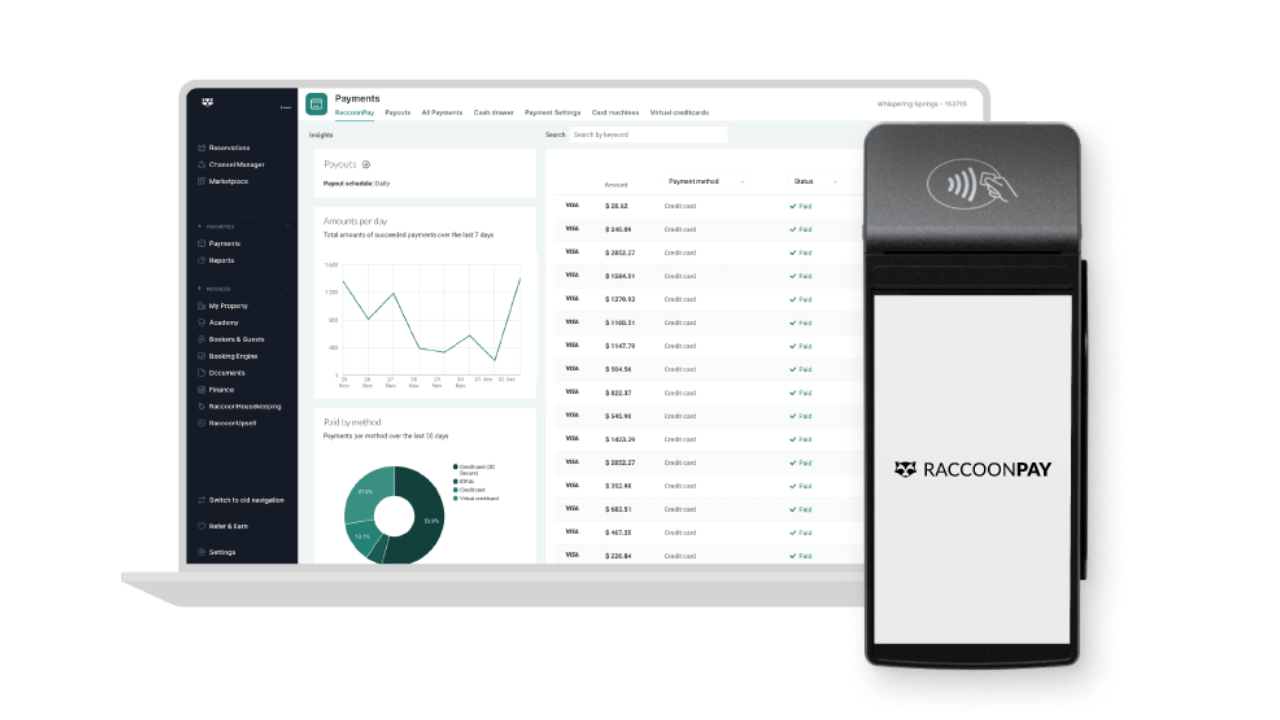

Hotel payment processing software like RaccoonPay adheres to industry security standards and includes the most up-to-date fraud protection tools:

1. Security Compliance

One way to ensure hotel payment processing software is secure is by validating its PCI compliance. Anyone involved with the processing, transmitting, or storing of card data must comply with the Payment Card Industry Data Security Standards (PCI DSS) and Payment Service Directive 2 (PSD2), the highest standards for processing online payments.

RaccoonPay has been audited by an independent PCI Qualified Security Assessor (QSA) and is certified as a PCI Level 1 Service Provider.

2. Payment Tokenization

The simplest way to be PCI compliant is never to see (or have access to) card data. This is known as tokenization. The process replaces actual card details with a unique alternate code known as the ‘token.’

For example, when guests insert their credit card details during a booking, the sensitive data will be replaced by nonsensitive data, which appears in your reservation or property management system. This way, you’re ensuring the safekeeping of your guests’ data.

3. Chargeback Support

A chargeback occurs when a hotel guest reverses a hotel payment after contacting their bank.

Chargebacks are prevalent, especially in the hotel industry, and they can’t be avoided altogether. However, it certainly helps to have chargeback support from your hotel payment provider. RaccoonPay offers a dedicated dashboard that enables you to easily manage, monitor, and dispute chargebacks from one screen.

Typically, after initiating a chargeback, you’ll receive a Notification of Chargeback in the dashboard and an email sent to you. From this point, you can choose to defend the chargeback within a defined time frame by submitting supporting documents. The claim is investigated and either accepted or rejected after a thorough examination.

4. Payment Authorization

Credit card authorization is commonly used by hotels as a simple and secure method to secure bookings and cover any incidentals or additional purchases during the guest’s stay. Merchants (hotels) can pre-authorize the customer’s credit card either at the booking stage or during check-in.

This pre-authorization ensures that sufficient funds are available to cover any charges incurred during the guest’s stay, such as room service or other amenities. It is crucial to note that these holds are temporary and will be lifted within a few days after the guest checks out of the hotel.

5. Prepayments

To secure reservations, a hotel equipped with a booking engine and payment processing system can request either full or partial payments during the booking process.

Making guests put down a security deposit is a smart move for hotels. It shows that the guests are serious about staying there. When people have money on the line, they’re less likely to cancel at the last minute.

Travel Tip: Given recent travel restrictions, many travelers are cautious about prepaid bookings. They prefer options with flexible cancellation policies and refunds in case of unforeseen circumstances.

6. 3D Secure 2.0

The most trusted symbol in online payments is 3D Secure 2.0. The industry-leading authentication protocol provides a smoother booking experience and adds an extra layer of security to hotel transactions with automatic two-factor customer authentication.

What does customer authentication mean? Simply put, the bank requires extra information from a cardholder to verify the purchase.

Authenticating purchases can significantly reduce the number of chargeback disputes and fraudulent transactions. It often involves sending a special code to the cardholder via text message or email. Some banks take advantage of available biometric data like fingerprint authentication and facial recognition through the customer’s mobile device.

A significant advantage of 3D Secure 2.0 for hotels is the liability shift for fraudulent transactions. Under this protocol, the issuing bank assumes responsibility for any chargebacks or disputes, protecting hotels from financial losses related to unauthorized transactions.

How Do 3D Secure Hotel Payments Work?

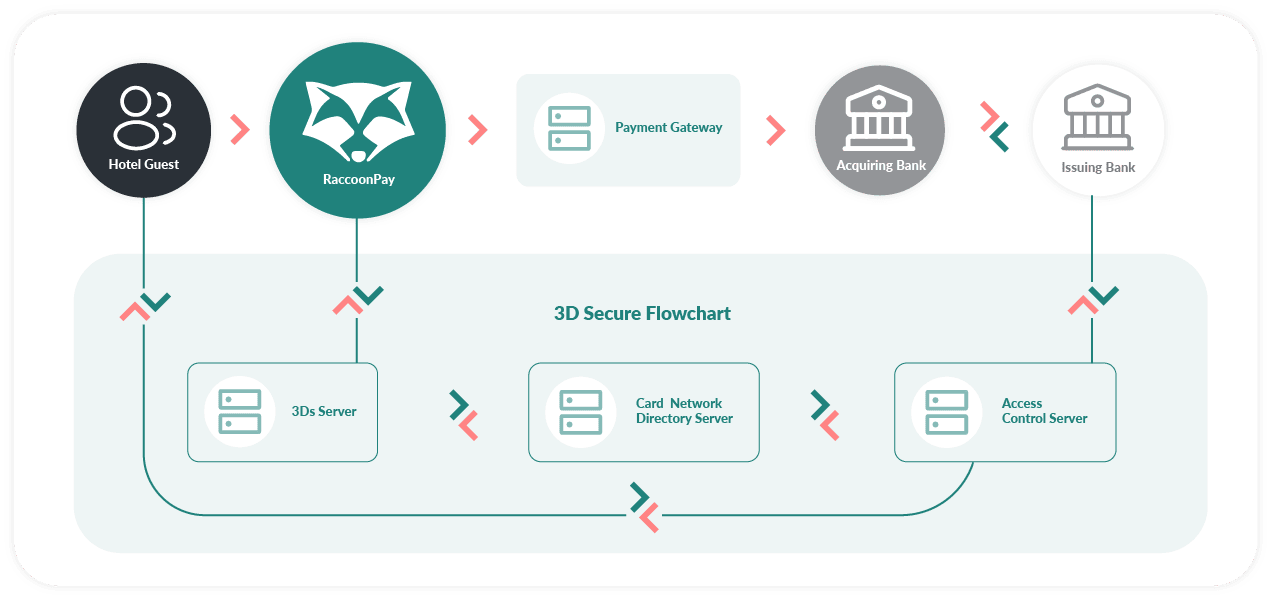

A 3D payment gateway functions similarly to a 2D payment gateway but with an extra verification step, as seen in the 3D Secure Flowchart below. The system checks whether or not the card is registered for 3D Secure and then redirects the card to a 3D Secure page served by the card provider. If the two-factor authentication goes successfully, the cardholder is then redirected back to the hotel website for payment confirmation.

In contrast, 2D payments only require a card number, expiry date, and CVV to pay online.

Checking Out

To accommodate tech-savvy guests and modern-day travelers, hotels are accepting payments through various methods and channels, including online payment links, e-wallets, and prepayments. With the growing number of payment options, enhanced security measures are essential for safeguarding hotel payment transactions.

Implementing a reliable payment gateway is crucial to ensuring risk-free transactions. Such gateways are equipped with the latest security standards and fraud protection tools, ensuring continuous software updates to keep payment processes secure.

Follow us

Nicky. M

Nicky is RoomRaccoon's Senior Content Manager, combining a love for travel with a practical approach to improving hotel performance through tech and insightful tips. Join her journey where travel, hospitality, and technology meet.

Related Posts

Subscribe to our newsletter for more on the latest hospitality & RoomRaccoon updates delivered straight to your inbox!